Introduction

FVGs Aren’t Breaks in Structure, They’re Bread-Crumbs Left by Smart Money

Markets don’t move in perfect balance. When institutional traders often called Smart Money execute large positions, price doesn’t glide smoothly. Instead, it leaves gaps of inefficiency behind areas where buyers and sellers didn’t meet in equilibrium.

These inefficiencies are known as Fair Value Gaps (FVGs), and they’re among the clearest footprints of institutional activity.

Understanding how and why these gaps form allows traders to anticipate where price will likely return before continuing in its original direction, giving you precision entries at value instead of chasing the market.

What Is a Fair Value Gap?

A Fair Value Gap is a price imbalance left behind when momentum displaces price too quickly for the market to efficiently fill orders.

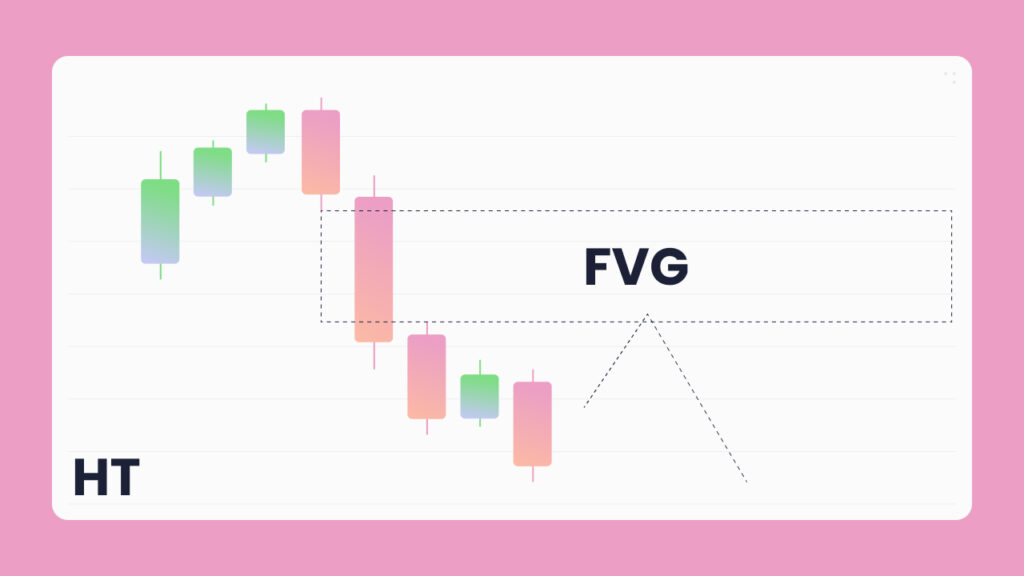

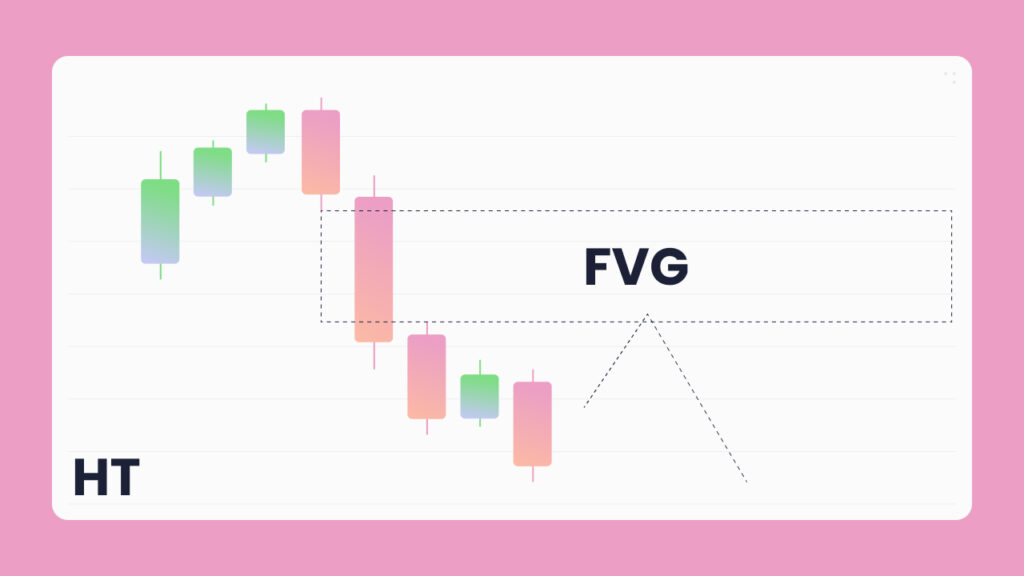

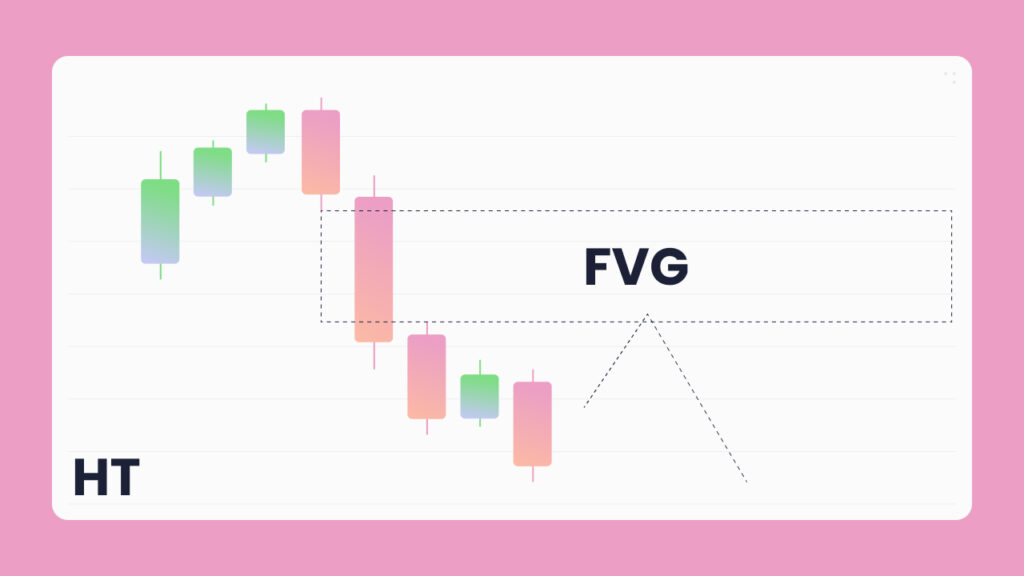

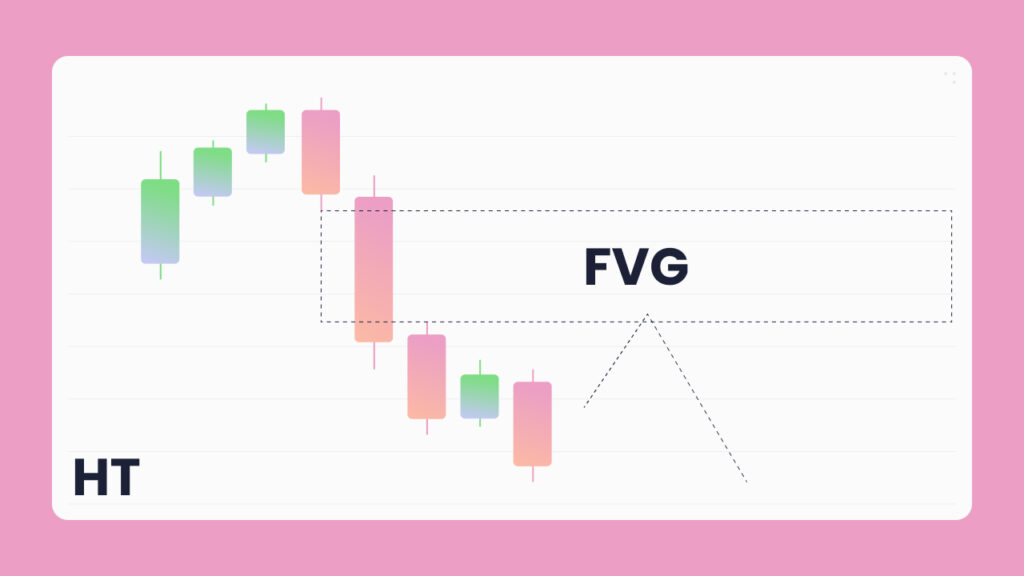

Technically, it forms through a three-candle pattern:

- Candle 1 creates a move in one direction.

- Candle 2 makes a strong displacement leaving a gap between the first and third candle’s wicks.

- Candle 3 does not overlap Candle 1’s wick, confirming an unfilled area in between.

That space between Candle 1 and Candle 3 is your Fair Value Gap a “price inefficiency” that often acts as a magnet for future price action.

How to Identify and Trade Fair Value Gaps

Follow this structured approach to spot and trade high-probability FVG setups:

Step 1

Identify the 3-Candle Pattern

Look for strong displacement, a clear, impulsive move that leaves space between Candle 1’s wick and Candle 3’s wick.

That unfilled zone is your Fair Value Gap.

Step 2

Mark the Zone

Highlight the gap between those wicks (or the body if you prefer tighter zones).

This zone represents inefficient price delivery where Smart Money may re-enter.

Step 3

Wait for the Retrace

Be patient. The best trades come when price returns into the FVG after displacement.

This is the “rebalance”, your low-risk, high-probability entry zone.

Step 4

Trade in the Direction of the Original Move

Once price taps into the FVG and confirms direction (for example, with a Break of Structure or liquidity sweep), trade in the direction of the original displacement.

Tip: Combine FVGs with Order Blocks and BOS for additional confluence and precision.

Example

Imagine GBP/USD breaks upward with strong momentum.

You spot a clear Fair Value Gap between Candle 1’s wick and Candle 3’s wick on the 5-minute chart.

Instead of chasing the breakout, you mark the FVG and wait.

When price retraces back into that zone, you look for a small structure shift or lower-timeframe confirmation, then enter long.

The result? A high-probability entry aligned with Smart Money, not against it. This same concept applies across Forex, Indices, and Gold, from intraday setups to swing plays.

Trading Style

Best For: Intraday & Swing Traders

Works On: Forex • Indices • Gold

Confluences: Order Blocks (OBs), Break of Structure (BOS), Liquidity Sweeps

Key Takeaways

✅ FVGs reveal inefficiencies caused by institutional displacement

✅ Price often retraces into these zones to rebalance before continuing

✅ Wait for price to return — don’t chase momentum

✅ Combine FVGs with OBs and BOS for refined confluence

Final Thoughts

Fair Value Gaps are not just “gaps” they’re windows into institutional intent.

By understanding where price is inefficient, you begin to trade in alignment with how Smart Money operates: entering at value, not emotion.

Build patience around FVG retracements, layer them with structure and liquidity concepts, and you’ll start seeing price movement as deliberate design, not chaos.

Introduction

FVGs Aren’t Breaks in Structure, They’re Bread-Crumbs Left by Smart Money

When Smart Money moves price aggressively, it leaves behind imbalances called Fair Value Gaps (FVGs) small unfilled areas on the chart where no trading occurred.

Price often retraces into these zones before continuing in the original direction.

The FVG Strategy focuses on identifying these inefficiencies and using them as entry points aligned with institutional flow.

The Core Framework

1. Identify the 3-Candle Pattern

Look for a clear three-candle displacement: Candle 1 and 3 do not overlap candle 2’s wick.

That void between them is your FVG.

2. Confirm Direction

The displacement candle defines direction:

- Bullish displacement = look for long entries.

- Bearish displacement = look for short entries.

3. Wait for Retrace

Price will often return to fill part of the gap this is your value zone.

4. Execute from Value

Enter when price retraces into the FVG and confirms continuation.

Stop beyond the gap; target external liquidity or next structural level.

Execution Tips

✅ Don’t chase displacement, wait for retrace.

✅ Combine FVGs with Order Blocks and structure confirmation for stronger setups.

✅ Works best within London & NY sessions where volume fills inefficiencies.

Summary

- FVG = imbalance left by displacement.

- Wait for retrace into the gap.

- Trade in the direction of the original move.

FVGs are where Smart Money re-enters the market not where it exits.

Introduction

Fair Value Gaps are rebalancing zones institutional inefficiencies created by displacement.

When liquidity is removed rapidly, Smart Money leaves an imbalance that price later re-tests to fill unexecuted orders.

These zones mark institutional re-entry, not retail continuation.

Execution Logic

- Displacement: Identify strong momentum candles that break structure and leave visible voids.

- Retrace: Wait for price to revisit the FVG, the 50% midpoint often acts as optimal entry.

- Confirmation: Align with structure, CHoCH/BOS, or order block confluence.

- Execution: Enter from the FVG midpoint; stop beyond gap; target liquidity or opposing imbalance.

Precision Notes

- FVGs work best when aligned with session timing and higher-timeframe bias.

- HTF FVGs act as magnets; LTF FVGs define entries.

- Combine multiple timeframe gaps for layered confirmation.

Principle

Smart Money fills inefficiencies before delivering price the FVG is where intent becomes opportunity.

Introduction

FVGs Aren’t Breaks in Structure, They’re Bread-Crumbs Left by Smart Money

Markets don’t move in perfect balance. When institutional traders often called Smart Money execute large positions, price doesn’t glide smoothly. Instead, it leaves gaps of inefficiency behind areas where buyers and sellers didn’t meet in equilibrium.

These inefficiencies are known as Fair Value Gaps (FVGs), and they’re among the clearest footprints of institutional activity.

Understanding how and why these gaps form allows traders to anticipate where price will likely return before continuing in its original direction, giving you precision entries at value instead of chasing the market.

What Is a Fair Value Gap?

A Fair Value Gap is a price imbalance left behind when momentum displaces price too quickly for the market to efficiently fill orders.

Technically, it forms through a three-candle pattern:

- Candle 1 creates a move in one direction.

- Candle 2 makes a strong displacement leaving a gap between the first and third candle’s wicks.

- Candle 3 does not overlap Candle 1’s wick, confirming an unfilled area in between.

That space between Candle 1 and Candle 3 is your Fair Value Gap a “price inefficiency” that often acts as a magnet for future price action.

How to Identify and Trade Fair Value Gaps

Follow this structured approach to spot and trade high-probability FVG setups:

Step 1

Identify the 3-Candle Pattern

Look for strong displacement, a clear, impulsive move that leaves space between Candle 1’s wick and Candle 3’s wick.

That unfilled zone is your Fair Value Gap.

Step 2

Mark the Zone

Highlight the gap between those wicks (or the body if you prefer tighter zones).

This zone represents inefficient price delivery where Smart Money may re-enter.

Step 3

Wait for the Retrace

Be patient. The best trades come when price returns into the FVG after displacement.

This is the “rebalance”, your low-risk, high-probability entry zone.

Step 4

Trade in the Direction of the Original Move

Once price taps into the FVG and confirms direction (for example, with a Break of Structure or liquidity sweep), trade in the direction of the original displacement.

Tip: Combine FVGs with Order Blocks and BOS for additional confluence and precision.

Example

Imagine GBP/USD breaks upward with strong momentum.

You spot a clear Fair Value Gap between Candle 1’s wick and Candle 3’s wick on the 5-minute chart.

Instead of chasing the breakout, you mark the FVG and wait.

When price retraces back into that zone, you look for a small structure shift or lower-timeframe confirmation, then enter long.

The result? A high-probability entry aligned with Smart Money, not against it. This same concept applies across Forex, Indices, and Gold, from intraday setups to swing plays.

Trading Style

Best For: Intraday & Swing Traders

Works On: Forex • Indices • Gold

Confluences: Order Blocks (OBs), Break of Structure (BOS), Liquidity Sweeps

Key Takeaways

✅ FVGs reveal inefficiencies caused by institutional displacement

✅ Price often retraces into these zones to rebalance before continuing

✅ Wait for price to return — don’t chase momentum

✅ Combine FVGs with OBs and BOS for refined confluence

Final Thoughts

Fair Value Gaps are not just “gaps” they’re windows into institutional intent.

By understanding where price is inefficient, you begin to trade in alignment with how Smart Money operates: entering at value, not emotion.

Build patience around FVG retracements, layer them with structure and liquidity concepts, and you’ll start seeing price movement as deliberate design, not chaos.

Introduction

FVGs Aren’t Breaks in Structure, They’re Bread-Crumbs Left by Smart Money

When Smart Money moves price aggressively, it leaves behind imbalances called Fair Value Gaps (FVGs) small unfilled areas on the chart where no trading occurred.

Price often retraces into these zones before continuing in the original direction.

The FVG Strategy focuses on identifying these inefficiencies and using them as entry points aligned with institutional flow.

The Core Framework

1. Identify the 3-Candle Pattern

Look for a clear three-candle displacement: Candle 1 and 3 do not overlap candle 2’s wick.

That void between them is your FVG.

2. Confirm Direction

The displacement candle defines direction:

- Bullish displacement = look for long entries.

- Bearish displacement = look for short entries.

3. Wait for Retrace

Price will often return to fill part of the gap this is your value zone.

4. Execute from Value

Enter when price retraces into the FVG and confirms continuation.

Stop beyond the gap; target external liquidity or next structural level.

Execution Tips

✅ Don’t chase displacement, wait for retrace.

✅ Combine FVGs with Order Blocks and structure confirmation for stronger setups.

✅ Works best within London & NY sessions where volume fills inefficiencies.

Summary

- FVG = imbalance left by displacement.

- Wait for retrace into the gap.

- Trade in the direction of the original move.

FVGs are where Smart Money re-enters the market not where it exits.

Introduction

Fair Value Gaps are rebalancing zones institutional inefficiencies created by displacement.

When liquidity is removed rapidly, Smart Money leaves an imbalance that price later re-tests to fill unexecuted orders.

These zones mark institutional re-entry, not retail continuation.

Execution Logic

- Displacement: Identify strong momentum candles that break structure and leave visible voids.

- Retrace: Wait for price to revisit the FVG, the 50% midpoint often acts as optimal entry.

- Confirmation: Align with structure, CHoCH/BOS, or order block confluence.

- Execution: Enter from the FVG midpoint; stop beyond gap; target liquidity or opposing imbalance.

Precision Notes

- FVGs work best when aligned with session timing and higher-timeframe bias.

- HTF FVGs act as magnets; LTF FVGs define entries.

- Combine multiple timeframe gaps for layered confirmation.

Principle

Smart Money fills inefficiencies before delivering price the FVG is where intent becomes opportunity.