THE BEGINNER’S BLUEPRINT TO BACKTESTING & FORWARD TESTING

(With Examples, Templates & a Simple Framework for Any Strategy)

Backtesting is one of the most powerful skills a trader can learn. Yet most traders avoid it because it feels too “technical,” too slow, or too confusing to start.

The truth?

Backtesting isn’t just for quants.

It’s for anyone who wants to stop guessing and start trading with confidence.

This mega guide breaks everything down from the basics to real examples, so you can test any strategy properly and build a trading system that actually performs in the real world.

1. What Backtesting Actually Is (In Simple Terms)

Backtesting is the process of taking a trading strategy and testing how it would have performed using past price data.

If you’ve ever:

- Tried a new indicator and wondered “Does this actually work?”

- Looked at someone’s YouTube strategy and thought “Hmm…”

- Taken a trade and didn’t know why it felt wrong

…then backtesting solves all of this.

What backtesting tells you

- Whether your idea has an edge

- How frequently the setup appearsv

- Your average win and average loss

- Total drawdown

- How long trades typically run

- Whether the strategy works in certain sessions or markets

- Whether you can realistically execute it

This is your quantitative foundation, your data-driven pillar.

2. Why Backtesting Matters (And Why Most Traders Fail Without It)

Most traders don’t fail because they have “bad discipline.”

They fail because they don’t trust their system because they never tested it.

Backtesting gives you:

✔ Certainty

You aren’t guessing whether your strategy works.

You’ve seen the results.

✔ Confidence

When a trade setup appears, you don’t hesitate.

✔ Consistency

You stop jumping between strategies and indicators every week.

✔ Control

You know your expected drawdown, so losing streaks feel normal — not scary.

✔ Clarity

You know exactly what to refine, improve or remove.

This is the foundation of serious trading.

3. How to Backtest (Step-by-Step Framework Anyone Can Follow)

Here is the simplest framework for backtesting that works for Forex, indices, crypto, stocks, everything.

Step 1: Define the Rules (No Vagueness Allowed)

Your strategy must be precise.

For example:

❌ “Enter when it looks like price will reverse.”

✔ “Enter long when RSI crosses above 30 and price forms a bullish engulfing candle at support.”

The clearer the rules, the cleaner the data.

Step 2: Choose the Market & Timeframe

Backtesting must be consistent.

Ask yourself:

- Will this be intra-day or swing?

- Do I want a high-frequency system or low-frequency?

- Which pair/asset suits the idea?

Example:

Strategy is built for Nasdaq (NQ) 1m & 5m because it’s based on momentum bursts.

Step 3: Scroll Back 12–24 Months of Data

The more data, the better.

You want samples across:

- Trending markets

- Ranging markets

- Volatile conditions

- Quiet conditions

A strategy that only works in one environment has no edge.

Step 4: Replay the Chart Candle by Candle

Use TradingView’s “Bar Replay.”

For every trade:

- Mark the entry

- Add SL & TP

- Track the trade until exit

- Log the results

Step 5: Record Everything (Your Data is the Edge)

You need these metrics:

- Setup name

- Date & time

- Market pair

- Entry, SL, TP

- R:R

- Win / loss

- Execution notes

- Emotions (yes, this matters!)

- Screenshots / video

- Final result

This is where FX Notes becomes the superior tool vs spreadsheets, because most beginners won’t manually track 100+ trades in Google Sheets.

Step 6: Run VERY Simple Maths

Once you have 50–200 trades, calculate:

You need these metrics:

- Win Rate

- Average Win / Average Loss

- Expectancy

- Profit Factor

- Maximum Drawdown

- Payoff Ratio (R:R)

These tell you the truth about your system.

4. Backtesting Examples (Simple & Clear)

Example 1: Support/Resistance Break & Retest

- Market: EURUSD 15m

- Sample size: 120 trades

- Win rate: 48%

- Average win: +1.9R

- Average loss: –1R

- Profit factor: 1.62

- Max drawdown: –6R

- Peak winning streak: 5 trades

Conclusion:

High-quality strategy, works best during London.

Example 2: NASDAQ Momentum Scalping

- Market: NQ 1-minute

- Sample: 200 trades

- Win rate: 36%

- Average win: +3.5R

- Average loss: –1R

- Profit factor: 1.21

- Drawdown: –15R

- Time in trade: 2–6 minutes

Conclusion:

Low win rate, high R:R, it’s emotionally difficult but profitable.

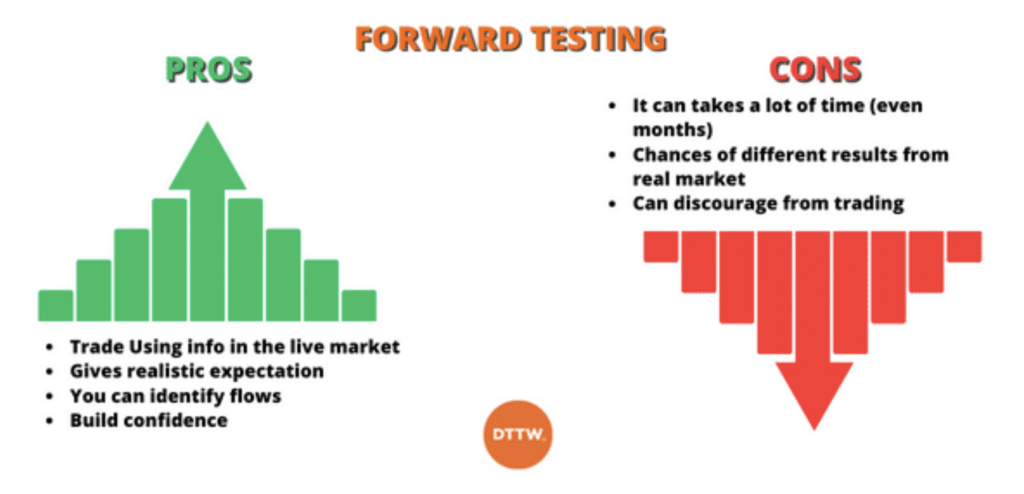

5. Forward Testing (The Step Most Traders Skip)

Forward testing is when you test your strategy in live market conditions using:

✔ Replay

✔ Demo Account

✔ Or tiny live positions

Most backtests fail in real-time because traders discover:

- Their rules weren’t clear enough

- Their stop loss was unrealistic

- Latency/slippage impacts results

- Emotions destroy good systems

- They need session filters

- They can’t execute scalps manually

- Real markets move differently to replays

Forward testing is where you validate the system on a small scale before risking real capital.

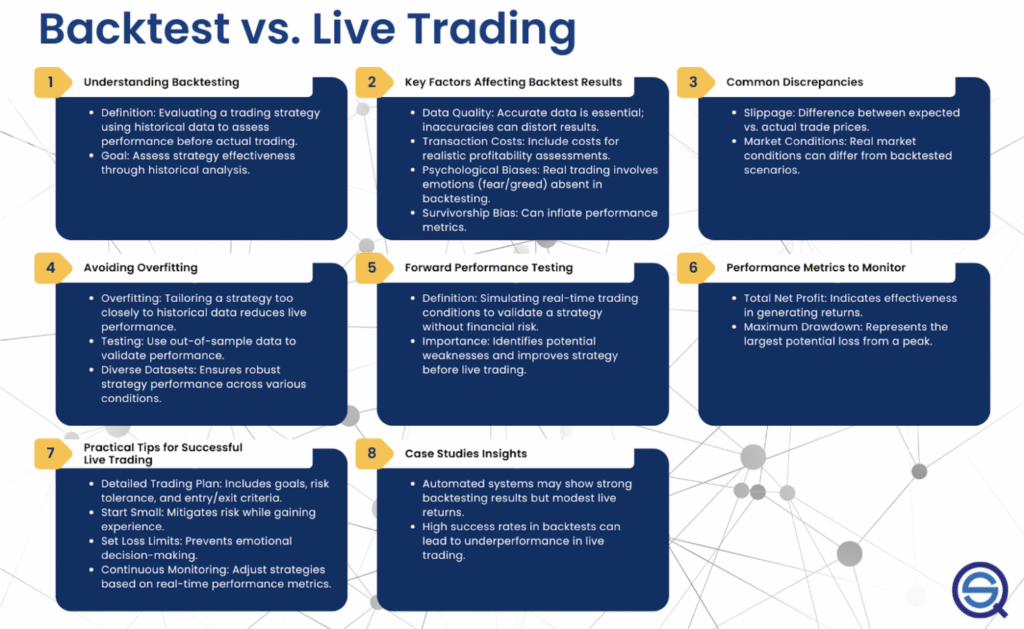

6. Backtesting vs Forward Testing (Simple Comparison)

Backtesting = theory

Great for understanding patterns & probabilities.

Forward Testing = reality

Great for understanding execution & psychology.

You need both.

7. How Much Backtesting Is “Enough”?

A simple rule:

50 trades minimum

For high-timeframe swing systems.

100–300 trades

For intraday & scalping strategies.

500+ trades

If you’re building a serious mechanical system.

8. The Metrics That Actually Matter

Here are the metrics Google users search for most:

• Win Rate

(Not the most important.)

• Average Win vs Average Loss

The real driver of profitability.

• Profit Factor

Profit / Loss.

Anything above 1.3 is strong.

• Expectancy

Your expected gain per trade.

• Maximum Drawdown

This predicts emotional resilience.

• Time in Trade

Does it fit your lifestyle?

• Session Performance

London, NY, Asia: Massive differences.

• Market Conditions

Trend vs range performance.

9. The Best Backtesting Tools (Simple Rankings)

1. TradingView

Best overall for beginners + pros.

Your main audience every time.

2. FX Replay

Specialised backtesting with metrics.

3. MT5 Strategy Tester

Good for EA/indicator developers.

4. Soft4FX Simulator

Forex-only, very detailed.

5. FX Notes (Your Positioning)

Not a chart simulator,

but the perfect post-trade analysis tool for:

- recording backtests

- tracking setups

- identifying patterns

- logging your psychology

- reviewing weekly stats

- storing all videos/screenshots in one place

Best overall for beginners + pros.

Your main audience every time.

10. Turning Backtesting Into a Trading System (Your 3-Stage Blueprint)

Stage 1: Backtest Your Rules

Validate the idea.

Stage 2: Forward Test for 20–40 Trades

Confirm execution is practical.

Stage 3: Execute Live With Small Size

Grow slowly as consistency improves.

A trader who follows this process almost automatically becomes profitable.

11. Example Template (Use in PDF & Website)

Strategy Name:

Market:

Timeframe:

Rules:

Entry:

Stop Loss:

Take Profit:

Trade Management:

Notes:

Emotional State:

Screenshots/Video:

Final Outcome:

12. Summary: Backtesting is the Shortcut to Confidence

Most traders try to shortcut the process.

Backtesting is the shortcut.

It gives you:

- A rules-based system

- Confidence during drawdowns

- Realistic expectations

- Emotional control

- Data-driven execution

- A clear roadmap for improvement

And when paired with FX Notes, traders gain the one thing backtesting can’t give:

self-awareness of why they made each decision.